Beijing is in the final stages of approving the 25-year $400 billion economic and security deal with Tehran dubbed Sino-Iranian Comprehensive Strategic Partnership. The media reports that the agreement incorporates massive Chinese investment in Iran's infrastructure envisions closer defense and intelligence sharing and guaranteed Iranian oil for China.

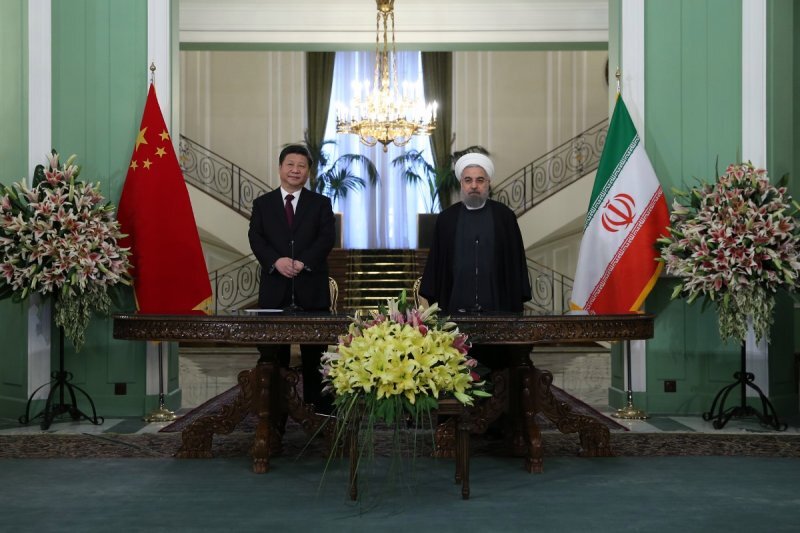

The partnership was in process since 2016 when China's Xi Jinping proposed it during his visit to Tehran. However, the proposal managed to remain low on the media radars and resurfaced when President Hassan Rouhani's cabinet approved it in June. Chinese and Iranian officials confirmed that it is a document which is labeled "final version" and dated June 2020.

According to the Indian business newspaper, the Financial Express, China is to invest $120 billion for upgrading Iran's transport infrastructure, beginning with the 2,300-km road that will link Tehran with Urumqi in China's Xinjiang province. This road will be dovetailed with the Urumqi-Gwadar link developed under the China Pakistan Economic Corridor under the "New Silk Road." The road link will provide connectivity with Kazakhstan, Kyrgyzstan, Uzbekistan, and Turkmenistan and thereafter via Turkey into Europe.

The timing of such a deal amid the immoral and crippling "maximum pressure" economic sanctions could not have been better for the Islamic Republic. For the downward slope in China-U.S. relations, the deal will further deteriorate the bilateral ties between the two largest economies of the world, and another round of trade war between the two countries is expected.

The rising geopolitical tensions between the U.S. and China are likely to hurt both sides and the global economy. In uncertain times people hedge on gold to protect personal savings. In the last week of July, gold price broke a record, reaching an all-time high of $1,921 an ounce.

China's new digital currency e-RMB could play an important role to bolster the Sino-Iranian pact as it would bypass American financial systems, and eventually reduce the power of the dollar. The move towards digital money has gained momentum globally amid the Covid-19 pandemic.

The U.S. dollar is the most powerful and influential currency in the current financial market. In 2019, the U.S. greenback made up nearly 90 percent of all international transactions and 60 percent of all foreign exchange reserves. The supremacy of the U.S. dollar gives U.S. economic sanctions their strength, making it nearly impossible for sanctioned nations such as Iran and North Korea to conduct international business.

Chabahar Free Trade Zone

Reported to be over three trillion dollars, China has the world's largest foreign exchange reserves. Some analysts argue that China is using the FOREX reserves to stretch its muscles and redraw the Asian map. It has used these reserves to invest in infrastructure projects in Africa and Asia mainly. Sri Lanka's Hambantota port was leased to China for 99 years after months of negotiations between China and South Asian island country the Lankan government handed over the port and 15,000 acres of land around it.

The transfer gave China control of territory just a few hundred kilometers off India's shores and a strategic foothold along a critical commercial and military waterway.

Pakistan owes China at least $10 billion in debt for the construction of Gwadar Port, which is leased to the Chinese government through 2059. Transit trade to Afghanistan via Gwadar port began on July 19 with a consignment of bulk cargo from the United Arab Emirates (UAE). With its 600-km coastline, Gwadar is a key deep seaport currently operated by China to gain direct access to the Indian Ocean in line with its $64-billion Pakistan-China Economic Corridor (CPEC) megaproject.

The future of the port of Chabahar, which was in part India's response to Gwadar port, hangs in the balance as the massive Iran-China deal incorporates infrastructure projects including airports, railways, and free trade zones.

The prospect that India could lose out on the rail line project connecting the port of Chabahar to the Afghan border city of Zahedan due to apparent delays to invest has raised questions about the foreign priorities of New Delhi.

The Indian Ocean port of Chabahar consists of two separate ports named Shahid Kalantari and Shahid Beheshti, each containing five berths. Iran awarded the development of this port to India, which committed $500 million to build two new berths in this port.

In 2016, India, Iran, and Afghanistan signed an agreement to establish transit and transport corridor using the Chabahar port linking the region to Central Asia and further west. The port will complement China in its Belt and Road Initiative for trade and travel links from China to Asia, Africa, and Europe.

In January 2017, seven agreements valued at over $3 billion were signed by Iranian, Indian, Omani, Chinese, and South Korean investors during a conference to promote investment opportunities and sustainable development in Mokran coastal area in the Chabahar Free Trade Zone (CFTZ).

India sent its first consignment of wheat to Afghanistan through the port in 2017. In June, Afghanistan sent three transit consignments to India via the Chabahar port. Afghanistan's first transit of goods to China was shipped through the port in mid-July.

Indian private industry firms, with the presence of Rashtriya Chemicals and Fertilizers and Gujrat State Chemical and Fertilizers, looked at the establishment of urea and ammonia plant in CFTZ, then Indian Ambassador, Saurabh Kumar told the Tehran Times in 2017, adding that the Indian private sector would be the main investor in CFTZ.

National Aluminum Company of Indian (NALCO) and Iran Mines and Mining Industries Development and Renovation Organization (IMIDRO) signed an agreement for an aluminum smelter plant in CFTZ.

Kumar added that the two countries were negotiating on important agreements on Preferential Trade Agreement (PTA), double taxation avoidance, and bilateral investment agreement (BIT). Representatives from Iran and India held a new round of negotiations on PTA in mid-February.

Head of Iran's Trade Promotion Organization (TPO) Hamid Zadboum and the present Indian Ambassador to Tehran Gaddam Dharmendra met early July to discuss the expansion of trade ties.

The second round of preferential trade agreement was to meet this week, It reported EurAsian Times, adding that the Iranian foreign ministry spokesperson has clarified their "balanced foreign policy" and that it is not favoring Beijing at the cost of Delhi.

Although India has traditionally maintained good ties with Iran, despite the waiver which Chabahar port got from the U.S. sanctions regime, India has been criticized for delays in investing in Iran's only seaport. Moreover, India has fully complied with the unilateral U.S. sanctions and has suspended its energy imports from Iran. Figures released by the Chinese officials show that although Iranian crude deliveries to China were never suspended but reached a 20-year low in March 2020.

Analysts see U.S. President Donald Trump's recent visit to India and his friendship with Indian Prime Minister Narendra Modi as a way for the U.S. to contain China's influence in the region. As well, the waiver that Chahbahar port got from the sanctions was another sign of Washington's efforts to contain Beijing.

India recently clashed with China in the Himalayas, and the bilateral relations are not at an all-time high, and the Chabahar port can be another venue for conflicting interests. Having good relations with India and China, Iran would prefer a situation whereby both countries could simultaneously benefit from the multi-modal development of the transport infrastructure at the Chabahar port.

Through such bilateral cooperation, the Chabahar port project could bring China and India closer. Recall the "Peace Pipeline" for transportation of natural gas from Iran to Pakistan to India? Unfortunately, the lack of political will prevented this project from implementation.

What happens to the development of the Chabahar port if the Majlis approves the Iran-China strategic 25-year strategic agreement remains a matter of speculation at the moment. The implication of this 25-year strategic deal with China doesn't necessarily mean deterioration of Tehran-New Delhi bilateral relations. On the contrary, it could shape up a new beginning for Beijing-New Delhi ties.

No comments:

Post a Comment